How It Works

Accelerator Structured Note

This is an example note and is used for educational purposes only

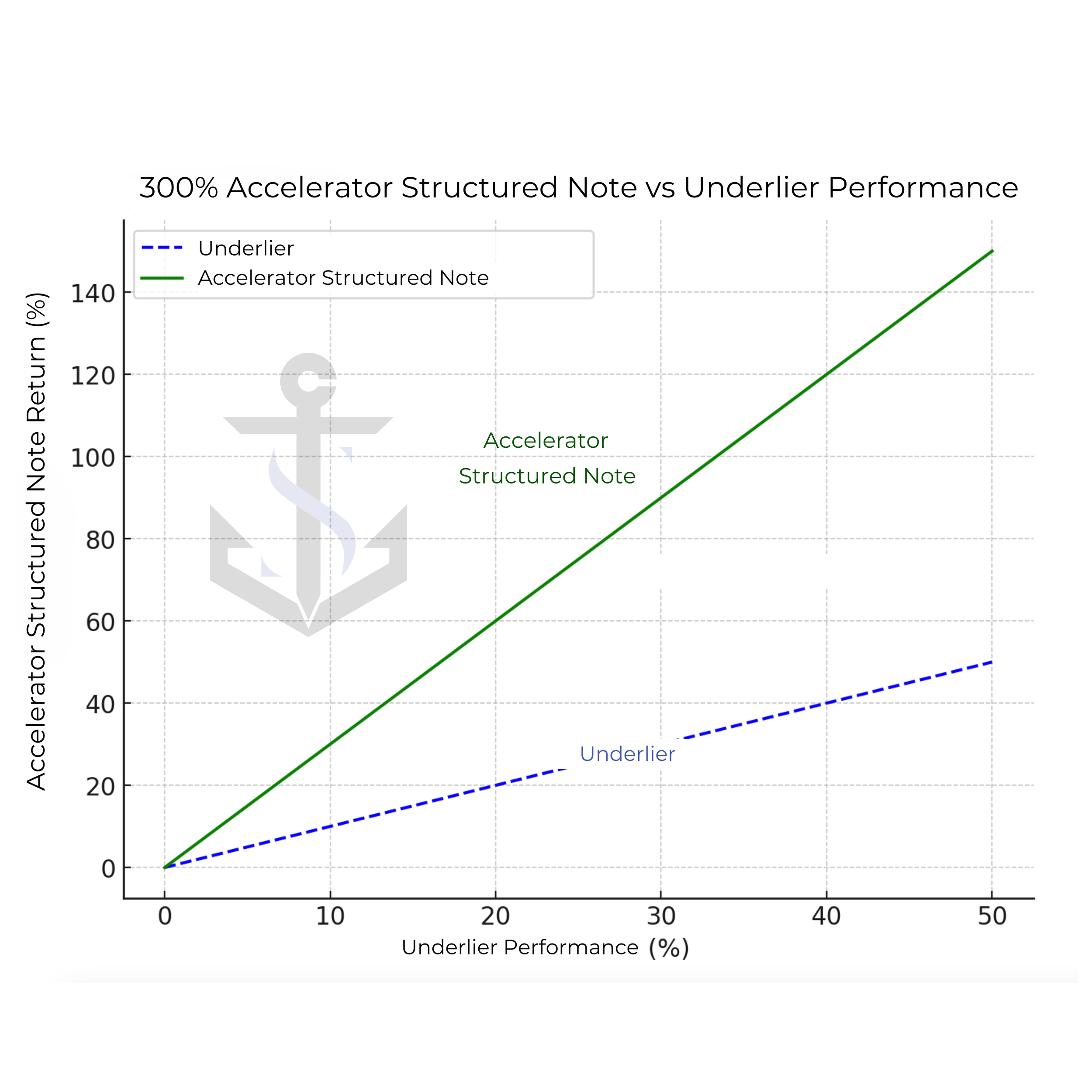

An accelerator structured note offers amplified returns when the underlying asset performs positively, with a cap on maximum returns, and sometimes a limited downside protection feature. Here’s a closer look at how it typically works:

1. Accelerated Upside: The note includes an “accelerator” multiplier. For example, if the underlying asset gains 5%, the note might provide a 2x or 3x return, meaning the investor would see a 10% or 15% return. See chart.

2. Cap on Returns: The upside potential is usually capped. If the asset’s performance exceeds this cap, returns stop increasing at that level. This cap helps the issuer manage costs and enables the acceleration feature.

3. Downside Protection: Some accelerator notes offer partial protection. If the underlying asset declines moderately (for instance, within a 10% to 30% range), the principal is protected. However, if the decline exceeds the protection level, losses are incurred.

4. Payoff at Maturity: At maturity, the final payoff is based on the asset’s performance, subject to the accelerator multiplier and cap. For example:

• If the asset gains 10% and there’s a 2x multiplier with a 15% cap, the note pays 15%.

• If the asset falls but within the protected range, the principal is preserved.

• If the asset declines beyond the protection level, losses are typically proportional.

Accelerator structured notes are ideal for investors looking to benefit from moderate asset growth with higher returns, while accepting capped gains and limited downside protection.

Structured notes can carry significant risks, particularly if the asset declines beyond the protection level.